As a proven provider of strategic consulting services,

our team has served a broad base of clients, from midsize to fortune 500,

across diverse industries such as financial services, government, technology, and healthcare.

Who We Serve.

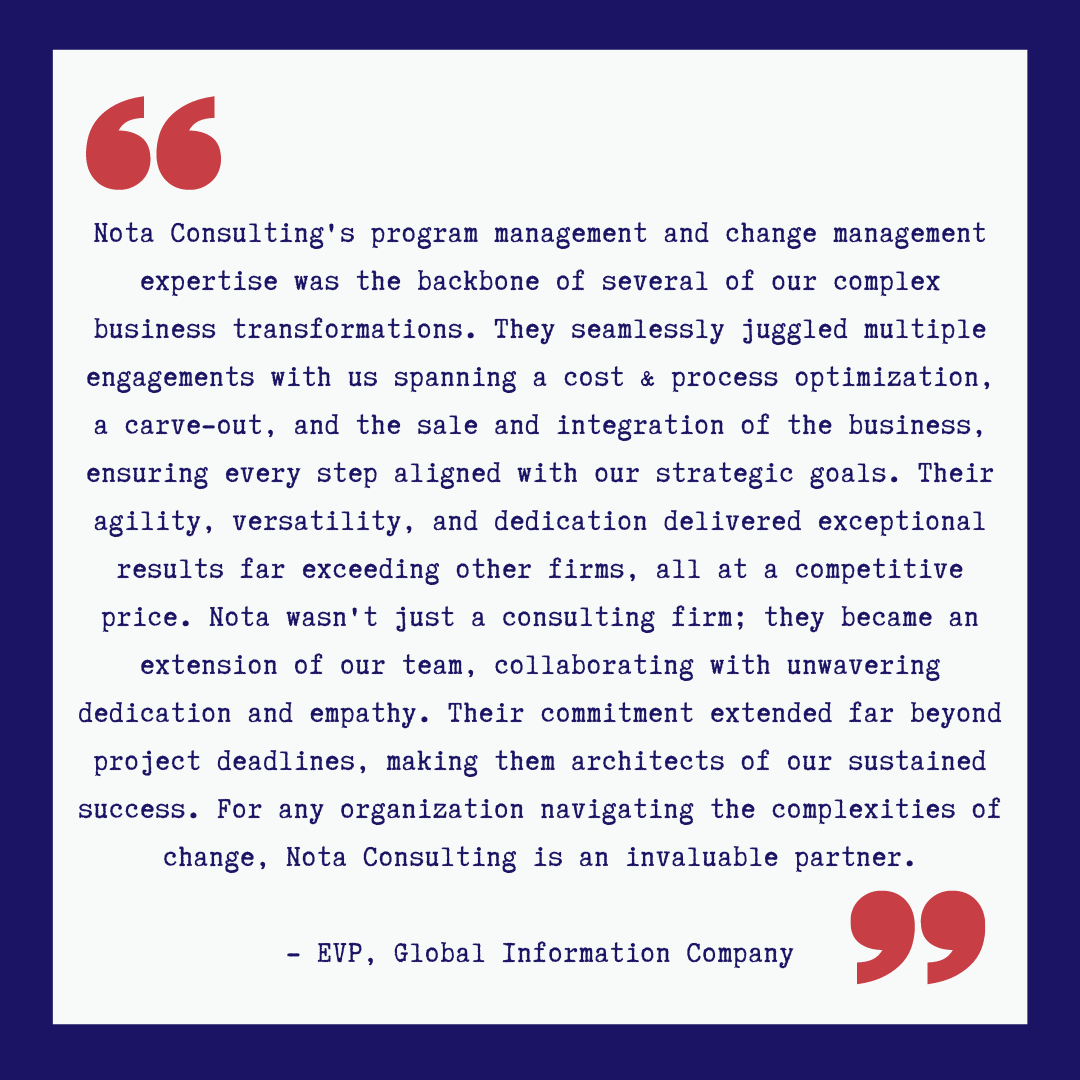

What makes us unique? Here’s what our clients have to say.

Our Work.

Process Re-engineering

Challenge

Inefficient data handoffs and undocumented processes within a global information services company resulted in more than 600 sellers receiving incorrect monthly commissions checks and more than 500 unresolved help desk tickets.

Approach

Collaborating as a trusted partner with our client, the team successfully redesigned the existing sales commission payment process for a global team with over 600 sellers, crafting an operational model that set the organization up for scalable progress.

Requiring a full analysis of the commission allocation and payment process, as well as the help desk ticketing process, we utilized our expertise in program management and process improvement to successfully lead the effort to reduce errors, streamline processes across multiple departments, and enable more than $30 million in annual commission payments.

To address the root cause of the organizational inefficiencies, our team stood up a cross-functional governance model reporting to the CFO and developed a project plan to support a full redesign of the current state process. This redesign spanned across PeopleSoft billing, Oracle Cloud ERP, Xactly and Varicent commission payment systems.

Beginning with a streamlined approach to the compensation ticketing process in Salesforce, we enhanced the triage workflow and reduced monthly help desk tickets by 70%.

We translated new efficiencies in the commission process and operational model into process maps and training materials. Our team developed and implemented an Organizational Change Management plan to support stakeholders through this change and led training efforts for the global selling team to ensure top down adoption for long term success.

Impact

Enhanced data integrity and enabled the launch of a sustainable process for more than $30 million in annual commission payments.

Reduced monthly help desk tickets by 70%.

Centralized automation leading to an increase in payment process efficiencies and 95% reduction in error rates.

Business Modeling

Challenge

Inconsistencies in allocation of revenue and understanding customers' usage of a connected planning platform led to a gap in leadership’s ability to make informed decisions on sales strategy, pricing, future product enhancements, and market competitive pricing bundles.

Approach

With the goal to help our client design, build, and market best-in-class planning applications, our team implemented a long term strategy that enabled the leadership team to make data driven decisions and prioritize strategic initiatives for scalable success. We worked with more than 1,500 global account teams to understand how our client’s customers were using their platform, validated data around this usage, and developed a detailed plan to allocate annual recurring revenue (ARR) to each individual use case.

Utilizing our project management and data analysis capabilities we led the validation of accounts to identify more than 5,000 use cases by customers of the platform. Once the use cases were identified, we developed and leveraged an allocation methodology to assign more than $500 million in ARR to the use cases. Our client leveraged this data set, and our analysis of their most valuable use cases by region and industries, as a foundational element of their go to market corporate strategy, including identifying expansion opportunities, updating pricing, applications development, and prioritizing the refinement of product bundles.

Impact

Analyzed customers usage across more than 1,500 accounts and allocated more than $500 million in ARR, leading to data driven decision making and go forward market strategy.

M&A Integration

Challenge

Post deal closing of a $3.1 billion acquisition, a lack of institutional knowledge hindered the ability of the buyer to transition from a Big Four consulting approach to a steady state integration plan for employees, processes, policies and systems.

Approach

Bringing together the cultures, employees, processes, policies and systems of two mature companies presents challenges for the most experienced buyer. Our client was beginning its acquisition journey, and lacked the institutional knowledge to build, maintain and support a cross- functional multi-year Integration Management Office (IMO).

After closely partnering with our team supporting the sell-side pre-acquisition process, the buyer, a global information company, engaged us to take over their IMO from a Big Four consulting firm. We refined their approach to better align to the company’s culture and processes and matured the program management by defining executable integration roadmaps across all corporate functions, including HR, Finance, Technology, Legal, Operations, Revenue, and Product organizations. Our project managers directly supported each function, and the IMO, to define and implement more than 200-integration milestones over a two-year program. Our executive report outs were leveraged from internal audiences up to the Board, and external earnings releases and analysts to show integration progress.

Post-acquisition the company has seen 14% revenue growth, and our IMO approach was documented as a best practice for their future integrations.

Impact

•Successful $3.1 billion acquisition and integration of a global information services company and its 1,700 employees.

•14% revenue growth post acquisition.

Cost Savings & Synergies

Challenge

Unclear responsibilities and processes to enable the capture of $80 million in cost synergies after an integration increased the risk of inefficiencies in resources, technology and vendor spending.

Approach

Ensuring the organization has a clear line of sight, concrete plans and accountable ownership to achieve cost synergies is a common issue our clients face. We have supported more than $300 million in cost synergies across multiple organizations, and have the knowledge in identifying and executing savings levers across people, technology, and vendor spend in a variety of industries.

We worked alongside our client ahead of a large-scale acquisition to identify $20 million in technology, people and vendor savings to help shape the organization for acquisition. Post-acquisition, we worked with the buyer to identify an additional $60 million in cost synergies and led the three-year initiative alongside the Chief Financial Officer to track savings across more than 30 workstreams and achieve monthly and quarterly targets.

To ensure success, we stood up and managed a rigorous governance model to achieve the financial targets and identify and mitigate risks. We partnered with functions across the organization to define owners, detailed execution plans and savings timelines for every workstream in the program while reporting our progress to the CEO, Board and Street.

Impact

•Enabled the business case for a $3.1 billion acquisition of a global information services company.

•Achieved 5% more savings than planned for $80M in synergies.

Divestiture

Challenge

Lack of clear governance and coordination across the sell-side (company, private equity and investment bank teams) and the buyer’s deal and integration teams resulted in a stalled deal process for a $218 million divestiture.

Approach

To support our client through the end to end deal process, we developed and maintained the overall program plan for all sell-side activities from Due Diligence through Closing for the carve-out of Neustar’s domain registry business to GoDaddy.

Reporting to the sell-side CEO, we led the coordination across the Golden Gate Capital private equity team, bankers and advisors. We also served as the single point of contact for all necessary communications on the buy side to ensure on time execution and delivery.

In preparation of the carve-out, we utilized our project management and business analysis capabilities to oversee the carve out plan and develop the Transition Services Agreement (TSA). Post-closing we partnered with GoDaddy to support the delivery of the TSA services across IT, back office, customer support, finance and sales for 12-months through wind down.

As part of the deal announcement we provided Neustar Registry and GoDaddy with detailed communication planning throughout the organization, to enable external announcements to the street and public, as well internally to the employees.

Impact

Enabled the coordination across stakeholders to close the $218 million sale of Neustar’s domain name registry business to GoDaddy.

Successful execution of TSA terms on time to wind down the monthly services.

Digital Transformation

Challenge

Complex Salesforce and Oracle Cloud implementation, and the underlying business processes and procedural changes, increased the risk of top-down adoption and roadblocks in sales, contracting and financial reporting.

Approach

In the age of constant digital transformation, the Nota team leveraged our expertise in organizational change management planning, training, project management, and communication to support our client through a Salesforce and Oracle implementation. We coordinated across business and technology teams to draft enterprise change management strategy to transition more than 1,900 global users to new systems and processes.

To support this change, the team also drafted and implemented process and system training guides for financial process changes while overseeing the project plan for a successful implementation. We collaborated across teams to develop and lead the release of key messages and enterprise communications to foster positive outcomes within a diverse, international deployment.

Impact

Successful deployment of Oracle Cloud and Salesforce Lightning to 1,900 global employees.

Take Private

Challenge

Post taking private a $10.4 billion enterprise connected planning software by a leading SaaS Private Equity firm, the company’s new executive team needed to remove more than $150 million in costs and implement a global reorganization.

Approach

Navigating the immediate priorities of a private equity firm to remove costs and enable profitable growth in the first-year post close, while balancing implementing a new strategy and culture with a company’s new executive leadership team, is a common challenge of a new portfolio company. Our clients, the Chief Strategy Officer and Chief Financial Officer, inherited a global reorganization and cost savings plan from a big Four Four consulting firm, and required implementation support to align to their corporate strategic priorities and the company's ways of working.

Leveraging program management and business analysis methodologies, in less than 30-days we engaged the executive team to validate more than $150 million in cost savings projects, develop implementation plans, identify executive sponsors, and build and stand up the governance structure to execute the program. Cost savings levers executed including transitioning the engineering, software development, platform and product resources to an offshore managed service provider, and redesigning the Go To Market account teams, human resources, finance and legal support teams, as well as savings in vendor spending, cloud migration and commission plans.

Working closely with the CFO and the FP&A team we assisted in the development of the overall financial model, and the financial tracking processes to track weekly achievement using the company’s planning software. To drive execution and maintain executive accountability we developed and facilitated monthly report outs to the CEO, and the Board, including status against financial and resourcing targets.

Impact

Defined and executed more than $150 million in cost savings post take private by SaaS Private Equity firm.

Global reorganization of more than 1,000 employees across functional areas, including Technology, Product, HR, Legal, Sales and Finance.

Organizational Change Management (OCM)

Challenge

A global information services company required an organizational change management strategy to ensure employee retention and engagement during the execution of a cost savings and efficiencies driven reorganization and offshoring program.

Approach

Our team orchestrated a comprehensive change management strategy for various functions across the enterprise, including, HR, Global Technology, Finance, Operations, US Markets, Legal, International, and Solutions to help to facilitate the smooth transition of the reorganization. We crafted a change management plan and roadmap, ensuring the timely execution of changes across those various departments. Through a stakeholder analysis, we identified key roles, team, and interdependencies, gauging the level of change required to tailor our approach effectively.

We fostered collaboration with relevant stakeholders to integrate change management seamlessly into project delivery. Working closely with the communications team, we implemented a communication plan and key messaging clearly outlining the impacts and changes and the strategic direction of the organization moving forward with a large-scale transformation. Additionally, we developed toolkits that could be leveraged across the organization to ensure managers were equipped with the appropriate tools and resources to help manage and sustain the changes pre and post reorganization.

Post implementation, the organization has seen around an increase of 20% in employee confidence in the future of the company.

Impact

20% increase in confidence in the future of the company.

Over 70% of the employees understand how the business is evolving post changes.